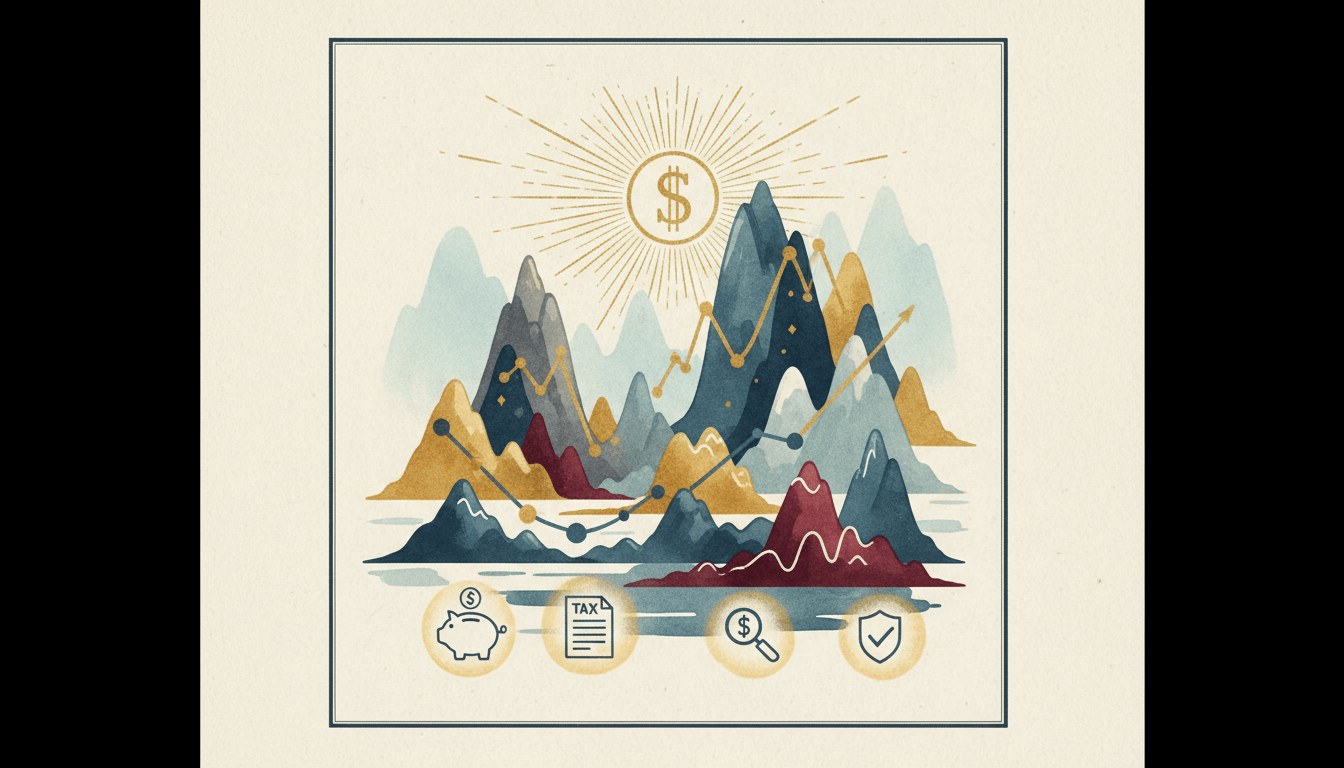

Tax Filing Essentials: Maximizing Your Refund and Compliance with IRS Guidelines

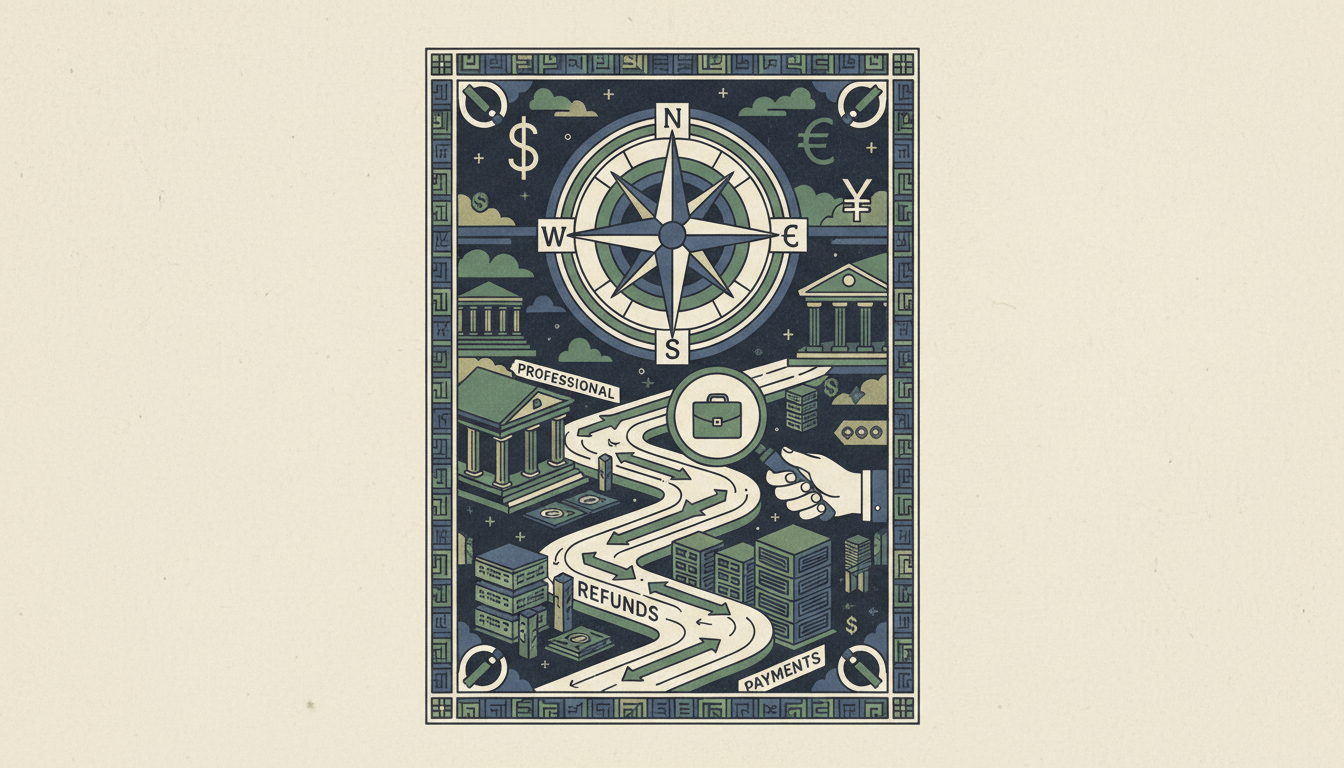

Navigating tax filing requires meticulous preparation and strategic planning to optimize refunds while maintaining full IRS compliance. This comprehensive guide details essential steps from gathering W-2s, 1099s, and income statements to leveraging electronic filing with direct deposit for 21-day refund processing. Learn critical updates on reduced Child Tax Credit and Earned Income Tax Credit amounts, plus strategies for accurately reporting all income sources including online platform earnings and investment income. With 168 million individual returns expected by the April 18 deadline, these professional insights help minimize errors and maximize financial outcomes.

Article Information

Author | Financial Advisor Team |

Date | October 28, 2025 |

Rating | 4.8 / 5.0 |

Would Recommend | Yes |

Helpful Count | 1785 |

Helpful Votes | 1785 |

Not Helpful Votes | 307 |