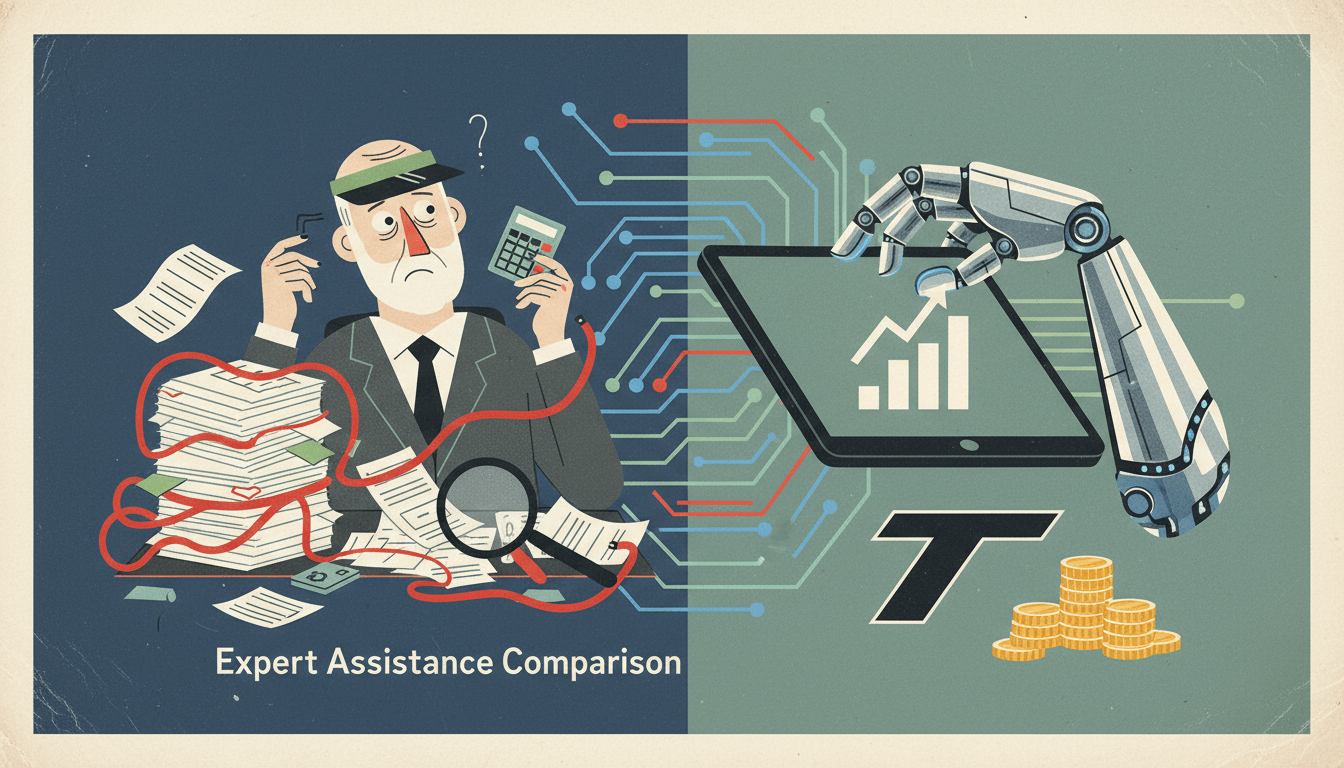

Expert Tax Assistance Comparison: TurboTax vs H&R Block vs TaxAct

This detailed comparison analyzes expert support features across leading tax software: TurboTax offers Live Assisted and Full Service with unlimited help from dedicated experts, H&R Block combines AI Tax Assist with live chat and in-person support at nationwide offices, and TaxAct provides Xpert Assist for a flat $60 fee across all plans. Availability varies by pricing tier, impacting access to professional guidance. Understanding these options helps taxpayers choose appropriate assistance levels for complex returns, maximizing deductions while ensuring compliance.

Navigating tax preparation requires precision, especially with evolving tax codes and individual financial complexities. Expert assistance embedded within tax software bridges the knowledge gap, offering real-time guidance to optimize deductions, credits, and compliance. This analysis compares TurboTax, H&R Block, and TaxAct, focusing on their expert support structures—ranging from AI-driven tools to human expertise—enabling users to select services aligned with their needs, whether handling simple returns or intricate financial scenarios.

TurboTax Expert Support

Pros

- Unlimited assistance ensures comprehensive help throughout filing

- Dedicated experts provide personalized, consistent guidance

- Live Assisted and Full Service options cater to diverse user preferences

- Seamless integration with software for real-time review and submission

Cons

- Higher cost tiers for premium support services

- Expert availability may require scheduling during peak tax season

- Limited in-person interaction compared to hybrid models

Specifications

H&R Block Expert Support

Pros

- AI Tax Assist offers instant, automated answers to common queries

- Live chat and in-person support at 10,000+ offices nationwide

- Hybrid model combines digital convenience with human touchpoints

- Flexible options suit both DIY filers and those needing full representation

Cons

- In-person support may involve additional fees or appointments

- AI limitations with highly complex, non-standard tax situations

- Service consistency can vary by office location and staff expertise

Specifications

TaxAct Expert Support

Pros

- Xpert Assist available for a flat $60 fee across all plan levels

- Cost-effective access to CPA and EA professionals

- Straightforward pricing without tiered expert-access restrictions

- Ideal for budget-conscious filers seeking reliable professional review

Cons

- Flat fee may not include unlimited revisions or complex case handling

- Fewer support channels compared to competitors (e.g., no in-person option)

- Limited to virtual assistance, potentially less personalized than dedicated experts

Specifications

Comparison Table

| Software | Support Options | Cost Impact | Best For |

|---|---|---|---|

| TurboTax | Live Assisted, Full Service | Premium pricing for expert tiers | Users needing comprehensive, hand-held filing with dedicated experts |

| H&R Block | AI Tax Assist, Live Chat, In-Person | Free AI; variable fees for human support | Filers valuing flexibility between DIY and professional help |

| TaxAct | Xpert Assist | $60 flat fee across plans | Budget-conscious individuals seeking affordable professional review |

Verdict

TurboTax excels with unlimited, dedicated expert support ideal for complex returns, though at a higher cost. H&R Block offers versatile AI and in-person assistance, suitable for those preferring hybrid solutions. TaxAct stands out with its flat-fee Xpert Assist, providing economical access to professional help. Ultimately, the choice depends on individual needs: TurboTax for maximum guidance, H&R Block for flexibility, and TaxAct for cost efficiency. Always verify current offerings, as plans and pricing evolve annually.