Mobile and Digital Experience in Tax Software: A Comprehensive Comparison

This analysis explores the mobile and digital capabilities of leading tax software platforms, including TurboTax, H&R Block, and TaxAct. We evaluate features such as automatic document importing, real-time guidance, and cross-device functionality, providing insights into how these tools enhance efficiency, accuracy, and user convenience during tax preparation. Based on current trends, this guide helps filers choose the best platform for their digital needs, whether through mobile apps or web interfaces.

The evolution of tax preparation has been significantly influenced by digital transformation, with mobile and online platforms offering unprecedented convenience and accuracy. Modern tax software integrates features like automatic document importing, real-time guidance, and seamless save-and-resume capabilities to streamline the filing process. This comparison examines the mobile and digital experiences of TurboTax, H&R Block, and TaxAct, highlighting how these platforms cater to diverse user needs through intuitive interfaces and advanced functionalities. By leveraging industry data and user feedback, we provide a detailed assessment to help taxpayers optimize their filing strategy, reduce errors, and maximize refunds efficiently.

Mobile Capabilities

Pros

- Enables on-the-go tax preparation with dedicated mobile apps

- Supports cross-platform synchronization for continuous workflow

- Offers user-friendly interfaces tailored for smartphone and tablet use

Cons

- Limited features in some apps compared to desktop versions

- Potential security concerns with mobile data transmission

- Varied performance across different mobile operating systems

Specifications

Digital Features

Pros

- Automates data entry through document importing (e.g., W-2, 1099 forms)

- Provides interactive, interview-style guidance for accurate filing

- Allows users to save progress and resume across multiple sessions without data loss

Cons

- Dependence on internet connectivity for real-time features

- Possible learning curve for users unfamiliar with digital tools

- Inconsistencies in feature availability across software tiers

Specifications

Comparison Table

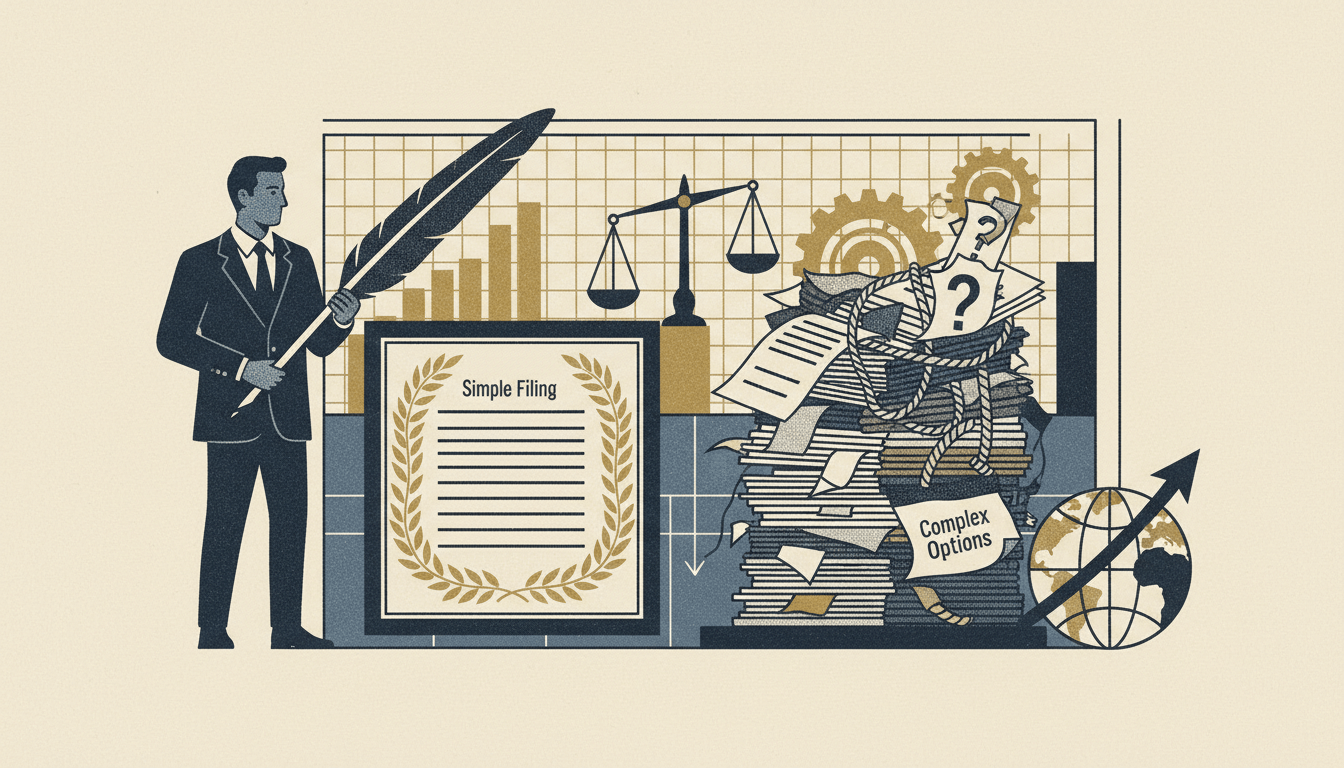

| Feature | TurboTax | H&R Block | TaxAct |

|---|---|---|---|

| Mobile App Availability | Full-featured iOS and Android apps | Comprehensive mobile interface | Basic mobile support |

| Document Importing | Yes, via photo and auto-fill | Yes, with photo capture | Limited to manual entry |

| Real-Time Guidance | Interactive interviews with live help | Step-by-step assistance | Basic prompts only |

| Save and Resume | Cloud-synced across all devices | Session recovery enabled | Partial functionality |

Verdict

TurboTax leads in mobile and digital experience with its comprehensive app and advanced features, ideal for users seeking full functionality and ease of use. H&R Block offers a strong alternative with robust mobile tools and reliable guidance, while TaxAct suits budget-conscious filers with basic digital support. For optimal results, choose software that aligns with your mobility needs and feature expectations, ensuring efficient and accurate tax preparation.