Charitable Contribution Deduction: A Comprehensive Guide to Itemized Tax Benefits

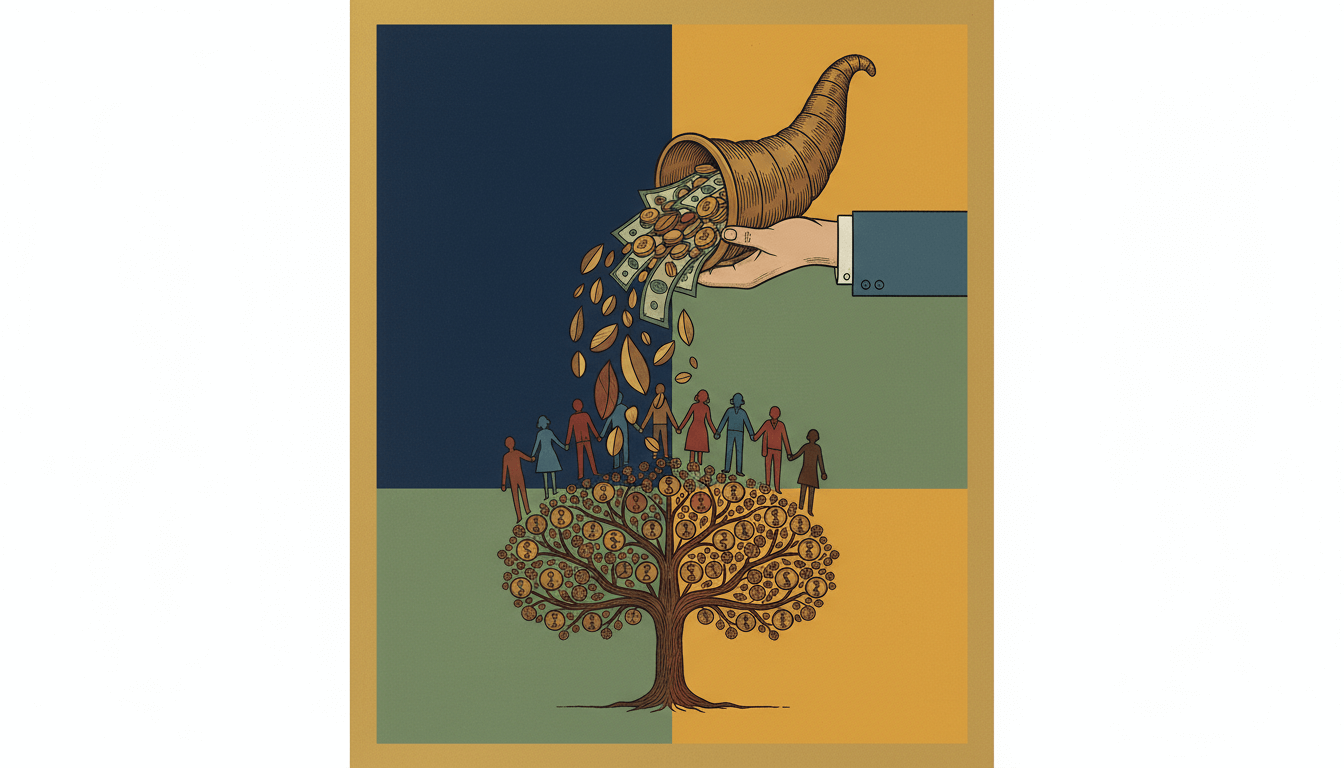

The charitable contribution deduction enables taxpayers who itemize to reduce their taxable income by donating cash or property to IRS-qualified nonprofit organizations. This incentive supports philanthropy while offering financial relief, requiring proper documentation like receipts and adherence to annual deduction limits. Eligible contributions range from monetary gifts to appreciated assets, with specific rules for non-cash items such as stocks or vehicles. Understanding eligibility criteria, record-keeping standards, and filing procedures ensures compliance and maximizes tax savings, making it essential for strategic financial planning.

Overview

The charitable contribution deduction is a pivotal component of the U.S. tax code, allowing individuals who itemize deductions on Schedule A of Form 1040 to subtract the value of donations made to qualified nonprofit organizations from their adjusted gross income (AGI). Governed by IRS guidelines, this deduction incentivizes philanthropic support for causes ranging from education and healthcare to religious and environmental initiatives. Taxpayers can deduct up to 60% of their AGI for cash contributions and 30% for certain non-cash donations, though specific limits apply based on the type of property and recipient organization. Proper documentation, including written acknowledgments for donations over $250 and appraisals for high-value non-cash items, is mandatory to substantiate claims. By reducing taxable income, this deduction not only lowers overall tax liability but also encourages sustained charitable engagement, aligning personal financial goals with societal benefit.

Specifications

Details

Eligibility Criteria

Taxpayers must itemize deductions, make contributions to IRS-qualified organizations, and maintain contemporaneous records. Donations to individuals, political organizations, or foreign entities are ineligible. Contributions must be made voluntarily without receiving substantial goods or services in return, though token benefits like membership privileges may be allowable if insubstantial.

Types Of Contributions

Cash donations include currency, checks, electronic transfers, and payroll deductions. Non-cash contributions encompass property such as clothing, household items, vehicles, stocks, and real estate, valued at fair market value at the time of donation. Appreciated assets held for over one year may qualify for enhanced deductions, avoiding capital gains tax.

Documentation Standards

For donations under $250, taxpayers need canceled checks, bank statements, or receipts. For $250 or more, a written acknowledgment from the organization detailing the donation amount and confirming no goods/services were provided is required. Non-cash donations over $500 require Form 8283, and those over $5,000 need a qualified appraisal appended to the tax return.

Common Pitfalls

Overlooking deduction limits, failing to obtain timely acknowledgments, misvaluing non-cash items, or claiming ineligible organizations can trigger IRS audits. Donations of services or time are not deductible, though related unreimbursed expenses (e.g., mileage at 14 cents per mile) may qualify.

Comparison Points

Itemizing vs. Standard Deduction: Charitable deductions only benefit those whose total itemized deductions exceed the standard deduction—$13,850 for singles and $27,700 for married couples filing jointly in 2023.

Cash vs. Non-Cash Donations: Cash donations are simpler to document and deductible up to 60% of AGI, while non-cash donations often require appraisals but can provide higher value deductions for appreciated assets.

Annual Limits: Unlike some deductions with fixed caps, charitable limits are AGI-based, allowing flexibility for high-income donors but necessitating careful planning to avoid disallowances.

Important Notes

Taxpayers should consult IRS Publication 526 for exhaustive rules and annual updates. Bunching donations into a single tax year may help surpass the standard deduction threshold, maximizing benefits. Recent legislation, such as the CARES Act, temporarily allowed deductions up to $300 without itemizing, but such provisions require verification for current applicability. Always retain records for three years from filing date to support claims during audits.