Home Office Deduction: A Complete Guide for Self-Employed and Remote Workers

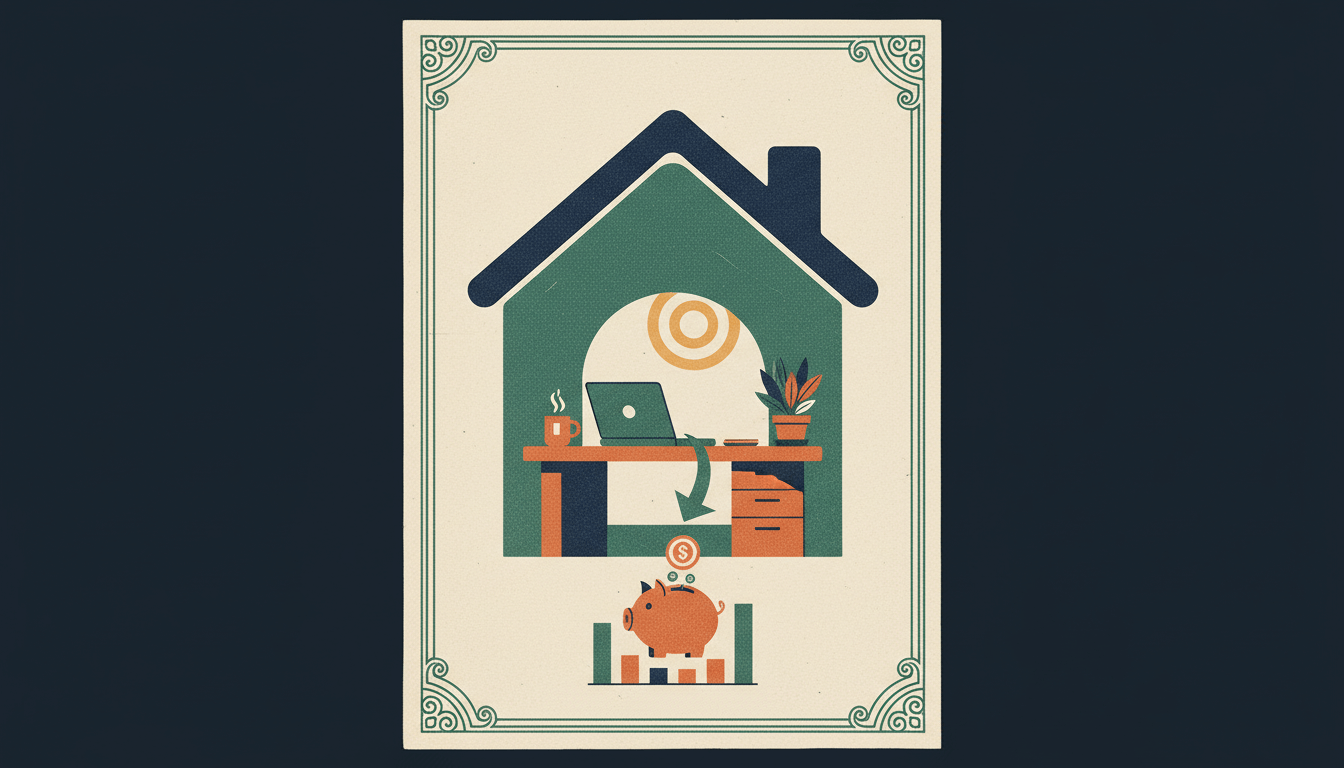

The home office deduction allows self-employed individuals and remote workers to deduct expenses for a workspace used regularly and exclusively for business. Eligible costs include portions of rent, utilities, real estate taxes, repairs, and maintenance, calculated based on the business-use area of the home. Proper documentation and adherence to IRS guidelines are essential to claim this deduction accurately and avoid audits. This guide covers eligibility, calculation methods, and common pitfalls to help you maximize tax savings.

Overview

The home office deduction is a valuable tax benefit for self-employed individuals and remote workers who use part of their home regularly and exclusively for business purposes. According to IRS guidelines and sources like NerdWallet, this deduction covers a portion of home-related expenses, such as rent, utilities, real estate taxes, repairs, and maintenance. To qualify, the space must be used solely for business activities, and the deduction amount is determined by the percentage of the home used for work. Proper calculation and record-keeping are critical to ensure compliance and maximize savings, with an estimated average deduction of $1,500 to $3,000 annually for eligible taxpayers.

Specifications

- Rent

- Utilities (electricity, water, gas)

- Real estate taxes

- Repairs (e.g., fixing a leak in the office area)

- Maintenance (e.g., painting the workspace)

Details

Step By Step Guide

1. Determine eligibility: Ensure the space is used regularly and exclusively for business. 2. Calculate business-use percentage: Divide the square footage of the office by the total home area (e.g., 150 sq ft office / 1,500 sq ft home = 10%). 3. Apply the percentage to deductible expenses: For $12,000 annual rent, deduct $1,200 (10%). 4. Choose a calculation method: Regular Method for precise claims or Simplified Option for ease. 5. File with tax returns: Include Form 8829 or Schedule C, and retain records for at least three years.

Common Mistakes

Claiming non-exclusive spaces (e.g., a dining table used for meals), overestimating business-use percentage, or failing to document expenses, which can lead to IRS audits and penalties.

Irs Guidelines

Refer to IRS Publication 587 for detailed rules; the deduction is only for the business portion of expenses, and any personal use voids eligibility. Recent updates allow deductions for multiple businesses if criteria are met.

Comparison Points

Regular Method vs. Simplified Option: Regular offers higher deductions for larger offices but requires detailed records; Simplified is faster but capped at $1,500.

Home office deduction vs. business expense reimbursements: Deductions reduce taxable income, while reimbursements are tax-free if provided by employers.

Self-employed vs. employees: Self-employed can claim directly; employees may need employer reimbursement plans.

Important Notes

Consult a tax professional for complex situations, such as mixed-use properties or high-value deductions. The home office deduction cannot create a net loss; it can only reduce taxable income to zero. Stay updated with IRS changes, as rules may evolve with remote work trends.