Cryptocurrency and Digital Asset Tax Reporting: A Comprehensive Guide to Compliance and Strategy

Navigating cryptocurrency tax reporting is essential for financial compliance and optimization. This guide details IRS requirements for capital gains, losses, and transaction tracking across various digital assets. Learn how to maintain precise records, apply tax-efficient strategies, and avoid penalties. With evolving regulations, staying informed ensures you accurately report crypto activities, from mining to trading, while maximizing deductions and minimizing liabilities through structured approaches.

Cryptocurrency and digital assets have revolutionized finance, but they come with complex tax obligations that demand careful attention. The IRS treats cryptocurrencies as property, meaning every transaction—buying, selling, trading, or using crypto for goods—can trigger taxable events. Failure to report accurately may result in penalties, audits, or legal issues. This guide provides a thorough overview of cryptocurrency tax reporting, covering key considerations like capital gains, transaction tracking, and compliance with IRS guidelines. By understanding these elements, you can maintain compliance, optimize your tax position, and navigate the evolving regulatory landscape with confidence.

Understanding Cryptocurrency Tax Reporting Fundamentals

Cryptocurrency tax reporting begins with classifying digital assets correctly. The IRS defines cryptocurrencies as property under Notice 2014-21, so general tax principles applicable to property transactions apply. This means that disposing of cryptocurrency—through sales, exchanges, or purchases—generates capital gains or losses. For instance, if you buy Bitcoin for $10,000 and later sell it for $15,000, you have a $5,000 capital gain subject to tax. Reporting requires documenting the fair market value of the asset at the time of each transaction. Additionally, income from mining, staking, or airdrops is taxable as ordinary income at its value when received. Accurate reporting hinges on maintaining detailed records, including dates, amounts, and purposes of transactions, to support your tax filings and avoid discrepancies during audits.

Tracking Capital Gains and Losses for Digital Assets

Capital gains and losses are central to cryptocurrency taxation. Short-term gains (assets held for one year or less) are taxed at ordinary income rates, while long-term gains (held over one year) benefit from preferential rates, typically 0%, 15%, or 20% depending on your income. To calculate gains or losses, use the formula: Sale Price - Cost Basis = Gain/Loss. For example, if you purchased 1 Ethereum for $2,000 and sold it for $3,500 after 18 months, your long-term capital gain is $1,500. Losses can offset gains and up to $3,000 of ordinary income annually, reducing your tax burden. Implementing specific identification methods (e.g., FIFO, LIFO) for cost basis calculation can optimize tax outcomes. Tools like cryptocurrency tax software automatically track transactions across exchanges, wallets, and DeFi platforms, ensuring accuracy and efficiency in reporting.

Maintaining Comprehensive Transaction Records

Robust record-keeping is non-negotiable for crypto tax compliance. The IRS mandates retaining records of all cryptocurrency transactions for at least three years from filing. Essential documents include: transaction dates, amounts in fiat and crypto, wallet addresses, exchange records, and receipts for crypto purchases. For mining or staking, log the date and value of rewards received. In 2023, over 30% of crypto taxpayers faced audits due to inadequate records. Use dedicated software or spreadsheets to track trades, transfers, and disposals, noting fees paid, as they can adjust cost basis. For complex activities like lending or liquidity pooling, document terms and earnings. Proper records not only support accurate Form 8949 and Schedule D filings but also defend against IRS inquiries, minimizing risks of penalties that can exceed 20% of underreported taxes.

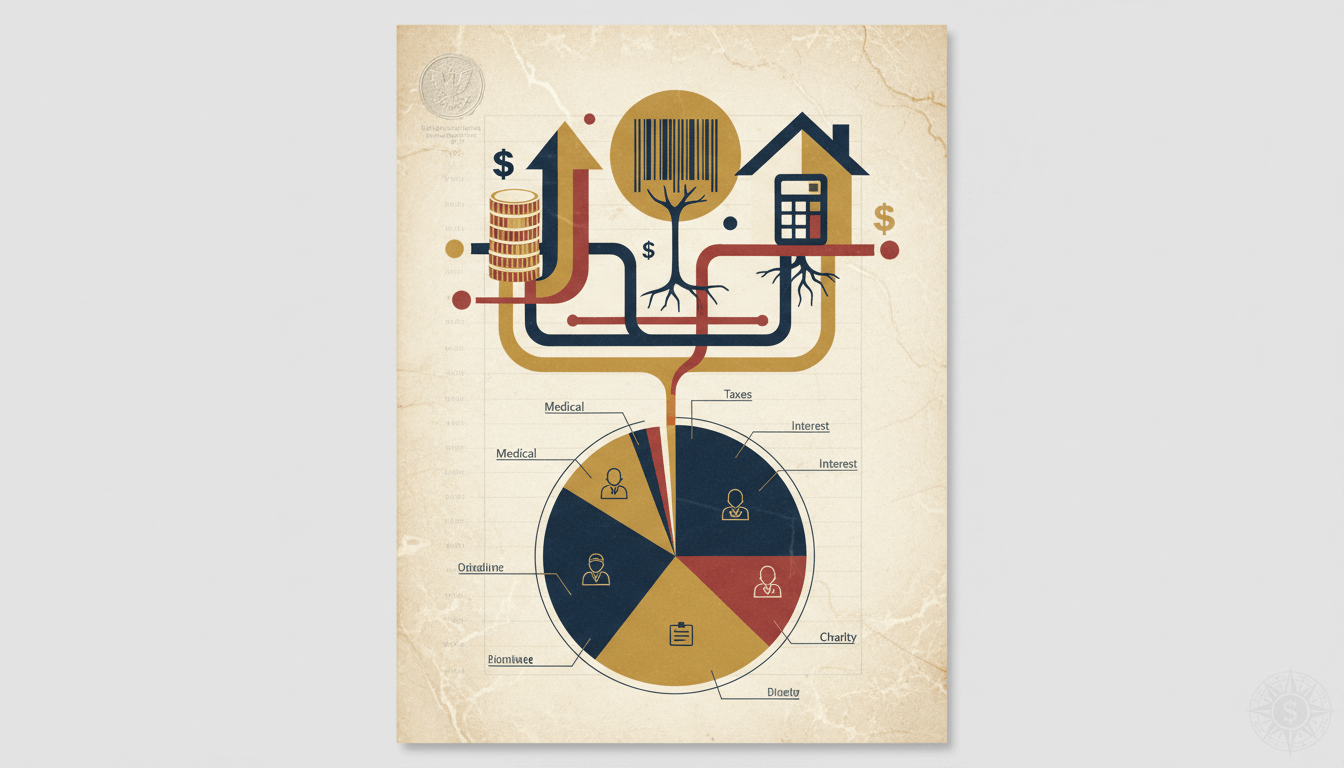

Strategies for Tax-Efficient Crypto Transactions

Adopting tax-efficient strategies can significantly reduce liabilities. Harvest tax losses by selling assets at a loss to offset gains; for instance, if you have $5,000 in gains and $3,000 in losses, your net taxable gain is $2,000. Hold assets long-term to qualify for lower capital gains rates—a strategy that saved investors an average of 10-15% in taxes in 2024. Consider gifting crypto to family in lower tax brackets or donating to charities, which may provide deductions without triggering gains. For frequent traders, entity structures like LLCs could offer deductions for expenses. Stay updated on IRS guidelines, such as those for hard forks or airdrops, to ensure compliance. By planning transactions and leveraging software for real-time tracking, you can maximize refunds and minimize burdens while adhering to evolving regulations.

Key Takeaways

Cryptocurrencies are taxed as property, requiring capital gains reporting on disposals.

Accurate record-keeping of all transactions is critical for IRS compliance and audit defense.

Use tax-loss harvesting and long-term holding to optimize tax outcomes and reduce liabilities.

Income from mining, staking, or airdrops is taxable as ordinary income at receipt value.

Leverage professional tools and strategies to navigate complex crypto tax scenarios efficiently.

Frequently Asked Questions

Do I need to report cryptocurrency if I didn't sell it?

Yes, if you received crypto through mining, staking, airdrops, or as payment, it is taxable as income at its fair market value when acquired. Only disposals (sales, trades, spends) trigger capital gains reporting.

How does the IRS track cryptocurrency transactions?

The IRS uses Form 1099-K, 1099-B, and blockchain analytics to monitor transactions. Exchanges report user data, and non-compliance can lead to penalties, so accurate self-reporting is essential.

What records should I keep for crypto taxes?

Maintain dates, amounts, cost basis, sale proceeds, wallet addresses, and transaction IDs for all activities. Keep records for at least three years to support filings and potential audits.

Can I deduct crypto transaction fees on my taxes?

Yes, fees for buying, selling, or transferring crypto can be added to the cost basis of the asset, reducing capital gains. Mining fees may be deductible as business expenses if mining is a trade or business.

Conclusion

Cryptocurrency tax reporting demands diligence and expertise to ensure compliance and optimize financial outcomes. By understanding IRS guidelines, tracking capital gains and losses meticulously, and maintaining comprehensive records, you can navigate this complex landscape effectively. Implement tax-efficient strategies like loss harvesting and long-term holding to reduce liabilities, and stay informed about regulatory updates. For personalized advice, consult a tax professional specializing in digital assets. With proactive management, you can turn tax obligations into opportunities for smarter financial planning and security.